[Correction 10/31: This post has been updated. The Herald-Tribune is in Sarasota, not Tampa. Sorry!]

The

Sarasota Herald-Tribune has an eye-opening article on the Bermuda-based reinsurance industry, explaining how Hurricane Katrina was seen by this segment of the industry more as a business opportunity than as a disaster. Here is an excerpt that describes what happened in the aftermath of the active and costly 2004 and 2005 hurricane seasons:

[I]in 2006, many reinsurers reduced the storm coverage they were willing to give Florida. Some purposefully refused to write policies for months, convinced they could extract an even higher price from insurers that neared collapse.

First-hand accounts, brokerage reports and copies of reinsurance contracts written that year show Florida insurers were still cobbling together hurricane protection in August and September, during the peak of danger, and paying three times the January rate.

The cost was paid by Florida property owners, some of whom suddenly faced premiums as high as their house payments. Real estate agents complained they were losing home sales as buyers no longer qualified for mortgages, and Florida bank leaders trouped to Tallahassee begging relief.

The squeeze was legal, and opportunistic.

“That's what we saw after hurricane Andrew and that's what will happen again, in my opinion, the next time we have a major hurricane,” said Steve Alexander, actuary for the office of the Florida Insurance Consumer Advocate.

The Herald-Tribune reports in some detail how the Bermuda reinsurers sought to capitalize on the post-Katrina opportunity:

THE STREETS OF New Orleans were still flooded in 2005 when reinsurers started raising money to pay for Hurricane Katrina and take advantage of the market boom expected to follow.

By December, Bermuda's reinsurers had raised $17 billion from eager investors, primarily hedge funds, private equity firms and U.S. investment banks such as Merrill Lynch, Goldman Sachs and Lehman Brothers.

But the flood of new money was not used to make more hurricane coverage available to Florida.

Reinsurance contracts and comments by executives show that even when they had money in the bank and board approval to use it, Bermuda reinsurers cut the capital they were willing to allot to Florida.

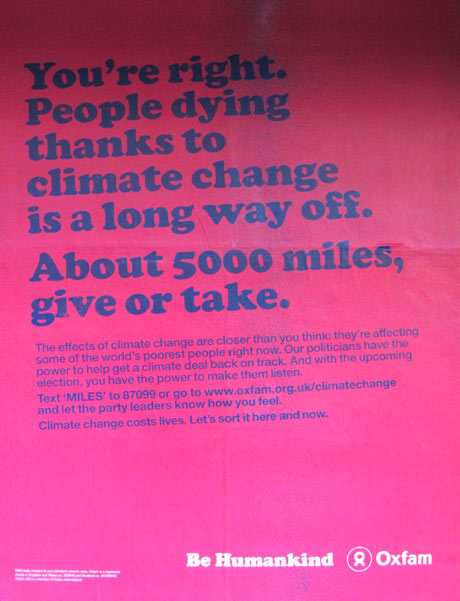

The layoff in part was driven by the belief global warming had increased hurricane risk, a view backed by some scientists hired by the insurance industry.

But it also was driven by a hunger to maximize profit — to, as ACE Ltd. Chief Executive Officer Evan Greenberg told investors in a 2006 earnings call, “ruthlessly take the elevator up at the right times.”

Rather than just ride Katrina-driven price increases, the Herald-Tribune found, reinsurers worked to make them bigger. They sat on business they normally would have signed. They turned away Florida insurers they normally would have backed.

“It's a good tactic to do this,” Aspen Reinsurance CEO Chris O'Kane told stock analysts in early 2006. When he spoke, Aspen had written only half its normal Florida contracts.

“We're confident that we will be able to replace a significant part of this lost exposure by the middle of this year at much better prices.”

O'Kane expected reinsurance prices to double because Aspen was not the only reinsurer refusing to write. Other reinsurers also were holding out.

Axis Capital chairman John Charman started the Florida writing season predicting severe shortages, and ended it by confirming in an earnings call, “We held back capacity.”

Other reinsurers were willing to write policies but seized on the opportunity to boost profits in other ways.

Montpelier Reinsurance, for example, stopped selling a broad form of coverage on which many Florida reinsurers relied and offered a more expensive substitute.

CEO Anthony Taylor urged analysts to be patient as the Bermuda reinsurer turned away early business. He would make it up later, he promised, earning 30 percent more while writing half the risk.

“This is an unprecedented market disruption,” Taylor said in the conference call, “providing opportunities for those who have available capacity.”

By July, Florida's cost to reinsure against the biggest hurricanes had tripled.

Aspen's O'Kane told analysts he still was withholding capacity, confident Florida insurers would return in a few months as “distressed buyers.”

Florida home insurers complained prices rose so fast they were “written in pencil.” Security First president Locke Burt, seeking rate increases of his own, told regulators he would secure a quote only to discover “a month later our price was two times, then three times” the quoted amount.

Florida regulators began a watchlist of insurers without full coverage at the start of hurricane season. Industry sources said five insurers were put under temporary supervision. Records obtained by the Herald-Tribune show at least one, United Property and Casualty, was still short in mid-September and operating under a regulatory consent order, even as it sought a state loan to expand.

The average cost of reinsurance coverage in Florida climbed from $9.90 per $100 in exposure to $20, the highest in the nation.

The average home premium increased 80 percent. Residents near the coast saw increases of 300 percent. More than 300,000 Florida families lost their private coverage, forced to find a new company or join Citizens, the state-run insurer of last resort.

A few industry leaders were troubled. Bill Riker, president at the time of Renaissance Reinsurance, said the Bermuda reinsurers overreached, hurting their own market. “The reinsurers didn't do themselves well at all,” he told the Herald-Tribune. They “lost track of what they're all about.”

Most reinsurers simply rejoiced. Aspen Re ended the year with a $378 million profit, more than double what it lost to Katrina.

The Herald-Tribune article begins to uncover some of the context that surrounds

the RMS 5-year forecast that I discussed yesterday, which was produced in the post-Katrina pricing frenzy described above. The RMS forecast was important because it gave a scientific veneer to the justifications for much higher pricing of reinsurance.

There is more to this story, of course, such as the fact that

contemporaneously RMS was busy inserting a misleading graph into the IPCC which falsely asserted a linkage between disaster costs and climate change (a graph that

RMS later admitted should not have been included). If the increase in reinsurance pricing were based on solid estimates of risk, that would be one thing.

If the increases were justifiable based on defensible judgments of risk, well, in that case the Bermuda reinsurers might risk getting a reputation akin to those who sell ice at inflated rates after a disaster, just because they can, which seems to be the tone of the Herald-Tribune article.

Another remarkable aspect of this issue -- quite apart from resinsurance but having to do with the IPCC -- is that the IPCC relied on a company with a clear conflict-of-interest for preparing its scientific assessment of the relationship of disasters and climate change. Even allowing that RMS behaved in line with its true beliefs at the time about the science, the appearance alone is troubling. And given that the IPCC has been shown to have been grossly wrong on this subject and its review process failed, we should all look with interest at how the IPCC proposes to handle COI in the future.